The following heat maps display two variables, the median age (years) and the unemployment rate (%), of countries by using colors on the world map (data source: CIA's World Factbook).

BI, DW, OLAP, charting, reporting, data visualization, dashboards, web user interfaces, searching for best practices

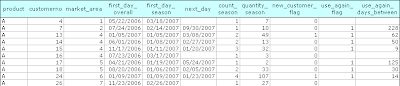

OK. This was only the first part. By using the new salesdata_prod_cust_pair table, you can write in SQL:

SELECT product,

SUM(quantity_season) "Total quantity of items sold",

100*SUM(new_customer_flag)/COUNT(*) "% new customers in this season",

100*SUM(use_again_flag*new_customer_flag)/SUM(new_customer_flag) "% willingness to use product/service again",

AVG(use_again_days_between/new_customer_flag) "Average days before using

product/service again"

FROM salesdata_prod_cust_pair

GROUP BY product;

.. and get the following results:

See the last two columns! For example the willingness to use product/service again is an excellent indicator to monitor how much your customers trust your products.

By using an XY chart you can visualize the data:

Let's analyze:

I think I'm done with the sales data for now. Next time, something else.

All this is interesting -- no less so because the basic line chart cannot express this knowledge.

Nevertheless it must be said that these charts don't yet tell anything about the prospects in different market areas. Adding facts about market area size (for each product) would help your decision making where to target your marketing in the next season.

Therefore, don't be satisfied with line and bar charts, if you can improve your decision making by using XY...

This is a personal blog. The opinions expressed here represent my own and not those of my employer.

Subscribe to: Posts (Atom)